Industry: Hospitality

Industry: Hospitality

Co-living marketplace

Company Info

30 - 50

Employees Supported

Xero

Accounting Software

- Sharing one founder's card for expenses

- Vendor bill payments done manually

- Lack of audit trail for reconciliation

- Employee Corporate Cards

- Bill Payments

- Accounting Software Integration

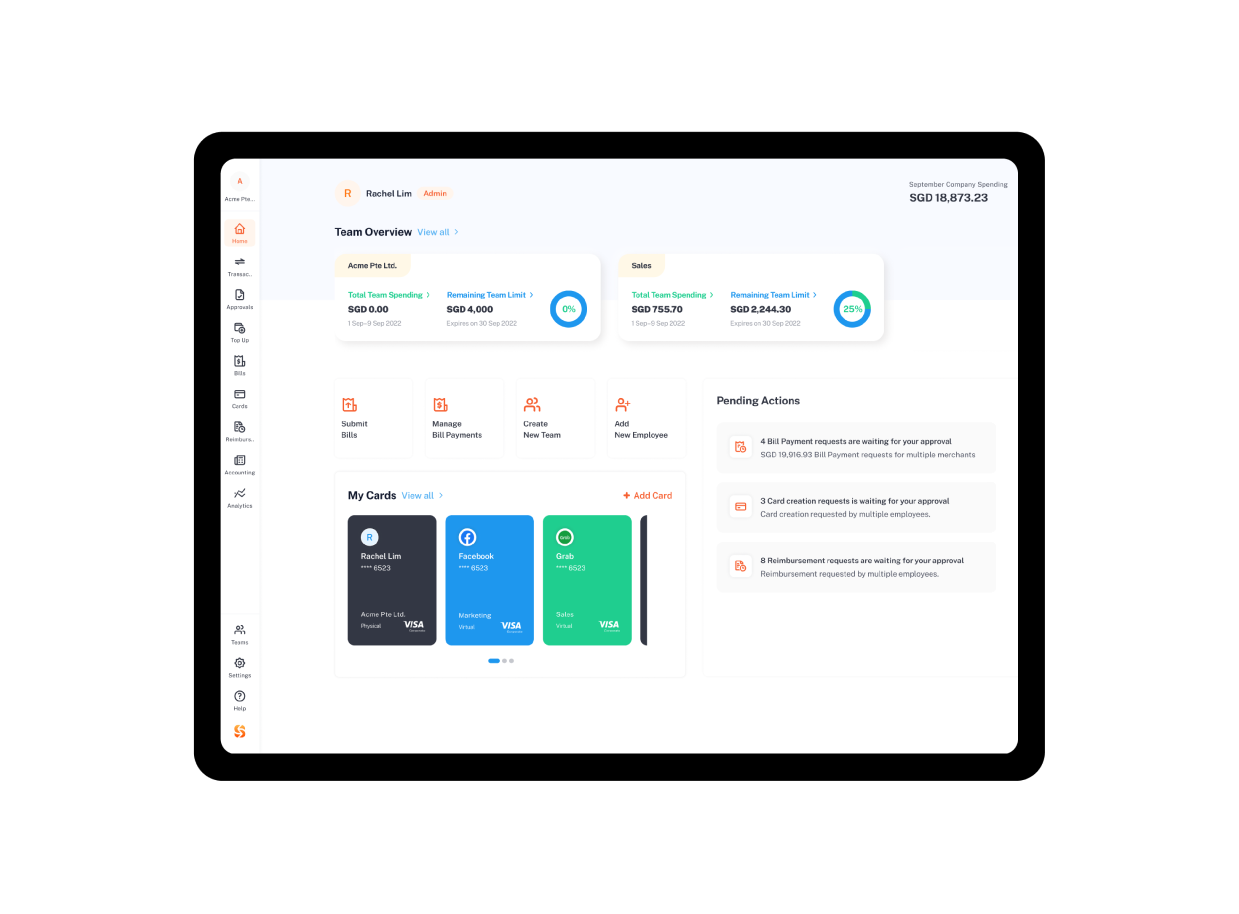

- Employee Corporate Cards with pre-assigned budgets for hassle-free and controlled spending

- Efficient Bill Payment process that reduces manual work and payment delays

- Seamless month-end expense reconciliation thanks to Spenmo's accounting software integration with Xero

Before adopting Spenmo's products, the Cove team used a single card shared among founders. This sharing arrangement caused several inconveniences, such as the need to contact one person for the OTP when others made transactions, as well as the manual task of identifying who initiated various transactions and reconciling them at the end of each month. As Cove was a growing company, they recognized the importance of eliminating these inefficiencies and were eager to leverage Spenmo for more efficient, centralized management of petty cash and employee expenses.

Additionally, they were seeking software that could facilitate both local and international vendor payouts, replacing the time-consuming manual process of making bank transfers to vendors. Cove, known for embracing innovative technology solutions in the hospitality sector as a property tech startup, naturally chose to explore Spenmo's digital solutions.

The primary reasons Cove decided to onboard with Spenmo were:

- The need for individual corporate expense cards for Cove employees, rather than a single shared card.

- The desire for efficient and timely payments to vendors, both locally and internationally.

- The requirement for a digital storage solution for receipts and invoices to facilitate a smooth reconciliation process with their existing accounting software and maintain a digital record of expenses.

1. Employee Corporate Cards with pre-assigned budgets for hassle-free and controlled spending

Before using Spenmo's cards, Cove employees had to use personal funds and wait for monthly reimbursements. Now, each employee has their own company card, with a pre-assigned budget to ensure control over spending.

Previously, they stored paper receipts and billing screenshots for monthly claims. With Spenmo, they attach digital receipts on the platform for easy end-of-month tracking.

Cove's subscription payments are now handled with virtual cards, and transaction data is captured in real-time, improving analysis and forecasting.

1. Employee Corporate Cards with pre-assigned budgets for hassle-free and controlled spending

Before using Spenmo's cards, Cove employees had to use personal funds and wait for monthly reimbursements. Now, each employee has their own company card, with a pre-assigned budget to ensure control over spending.

Previously, they stored paper receipts and billing screenshots for monthly claims. With Spenmo, they attach digital receipts on the platform for easy end-of-month tracking.

Cove's subscription payments are now handled with virtual cards, and transaction data is captured in real-time, improving analysis and forecasting.

2. Efficient Bill Payment process helped in reducing manual work and payment delays

As Cove expanded, managing various vendor invoices and billing cycles became increasingly challenging. To address this, they needed an automated solution for better cost tracking.

With Spenmo, Cove now benefits from an invoice drag-and-drop upload feature and Smart Scanning technology for accurate record-keeping. Additionally, multi-level approval workflows ensure rigorous bill approval, resulting in enhanced spend control. This allows Cove to efficiently approve and pay invoices from both local and international vendors, avoiding late penalty fees.

2. Efficient Bill Payment process helped in reducing manual work and payment delays

As Cove expanded, managing various vendor invoices and billing cycles became increasingly challenging. To address this, they needed an automated solution for better cost tracking.

With Spenmo, Cove now benefits from an invoice drag-and-drop upload feature and Smart Scanning technology for accurate record-keeping. Additionally, multi-level approval workflows ensure rigorous bill approval, resulting in enhanced spend control. This allows Cove to efficiently approve and pay invoices from both local and international vendors, avoiding late penalty fees.

3. Seamless month-end expense reconciliation with Xero integration

Before integrating Spenmo with Xero, Cove used to maintain paper receipts and screenshots, creating hassles during month-end expense reconciliation.

Now, with Spenmo's integration, bills are automatically synced into Xero, streamlining the entire process. Users can digitally attach receipts and reconciliations directly on the Spenmo platform, simplifying end-of-month tracking.

As a result, Cove enjoys a real-time, clear overview of their expenses and a robust audit trail, enhancing their month-end expense reconciliation process.

3. Seamless month-end expense reconciliation with Xero integration

Before integrating Spenmo with Xero, Cove used to maintain paper receipts and screenshots, creating hassles during month-end expense reconciliation.

Now, with Spenmo's integration, bills are automatically synced into Xero, streamlining the entire process. Users can digitally attach receipts and reconciliations directly on the Spenmo platform, simplifying end-of-month tracking.

As a result, Cove enjoys a real-time, clear overview of their expenses and a robust audit trail, enhancing their month-end expense reconciliation process.

- Efficient, instant invoice management

A platform that decentralises company expense spending, but has features that gives managers visibility and keep spending in check, saving countless hours of manual tracking.

These are the main use cases for Cove to onboard with Spenmo:

.gif)

Moreover, with the real-time expense data accessible through Spenmo's dashboard, Cove can now proactively manage and forecast future spending. This clear insight into their budgets offers a higher level of clarity, enhancing their ability to make informed financial decisions and maintain a tighter grip on their expenses.