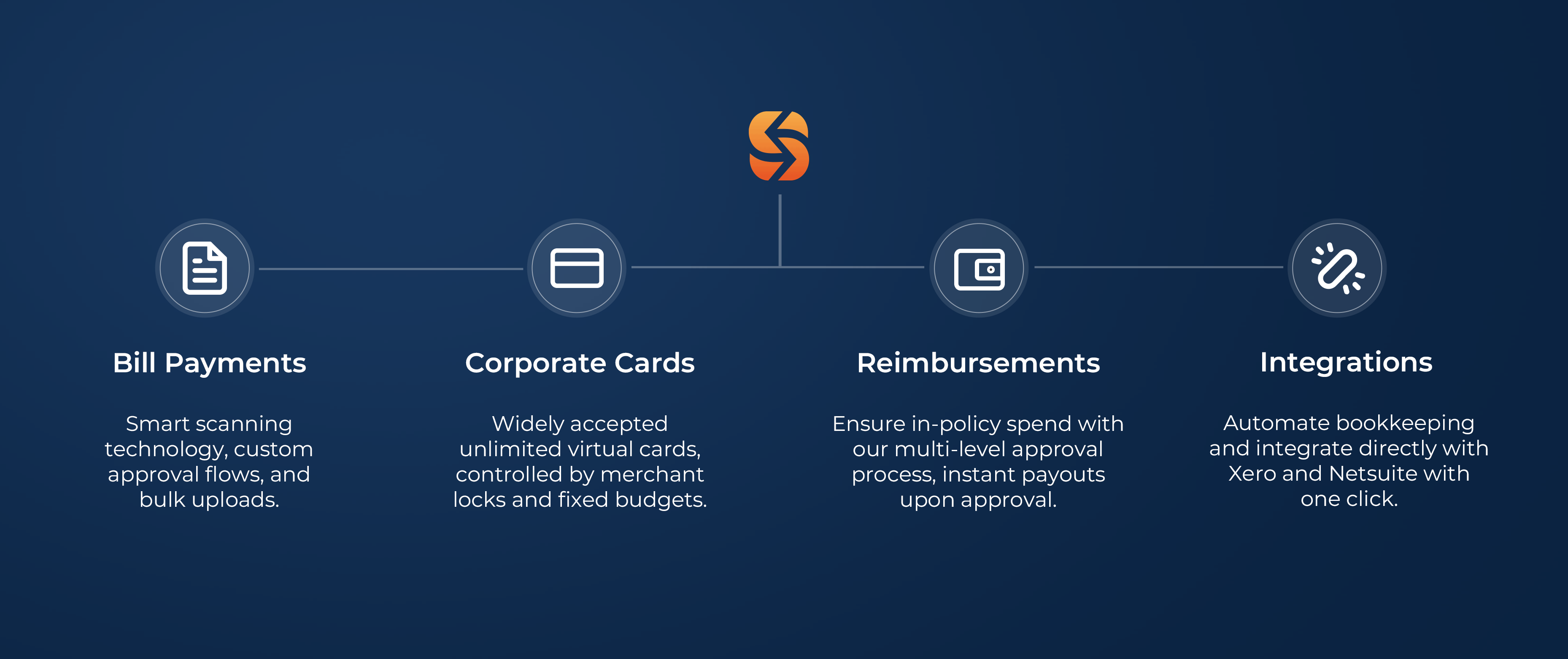

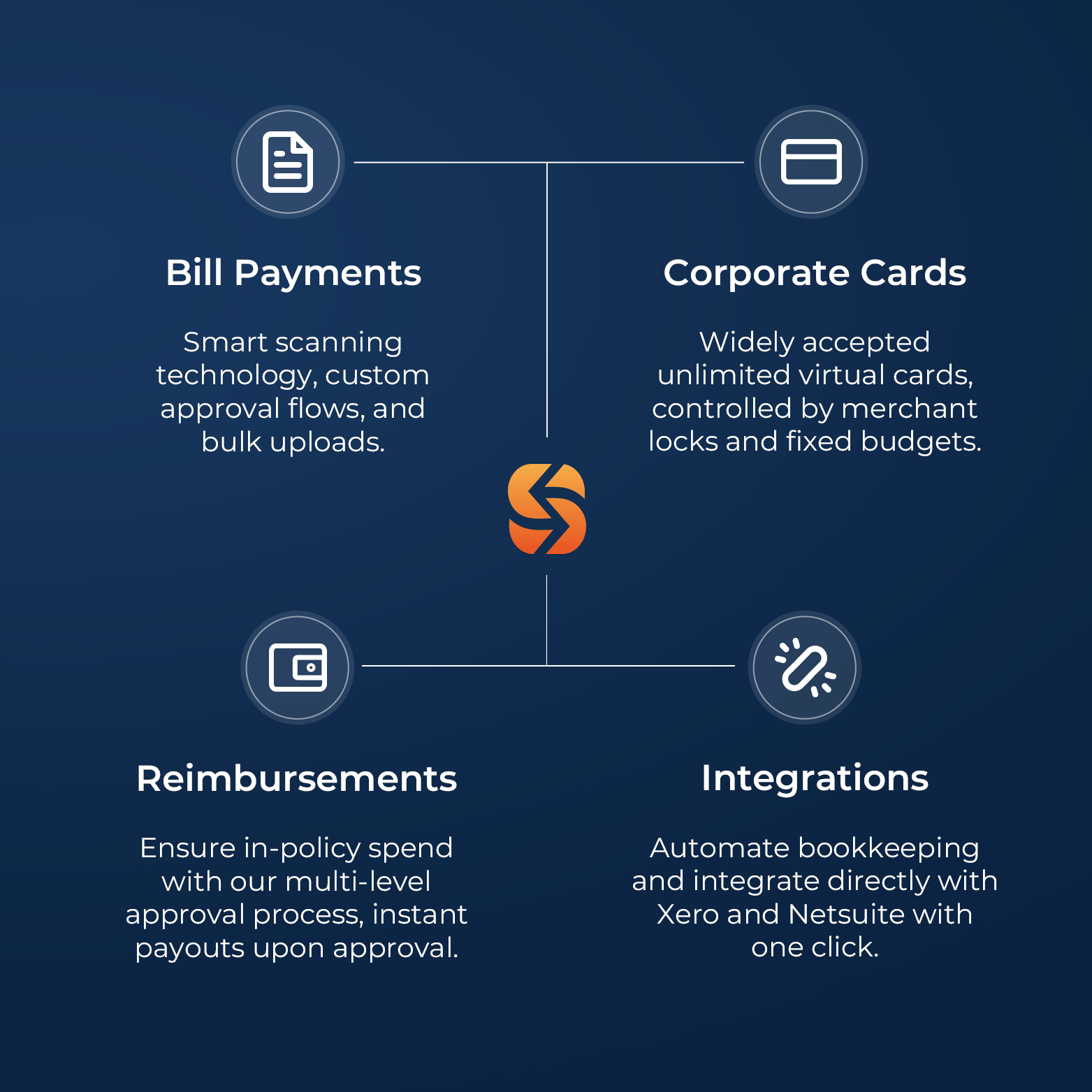

Streamline Company Spend While Maintaining Control

Spenmo empowers you with enhanced visibility and control to automate your existing spend management processes.

As of 14 August 2025 at 23:59:59 hours (Singapore time), Spenmo officially ceased its business operations and customer access to the Spenmo dashboard has been permanently disabled. Please also note that access to customer support for existing tickets ceased as of 21 August 2025 at 18:00:00 hours.

Over the past six years, it has been our privilege to support your business. We sincerely appreciate the trust and confidence you have placed in us and thank you for being part of the Spenmo journey.

– The Spenmo Team

Bill Management

Process your bills up to 90% faster

Reduce manual effort and errors while maintaining full control with our Smart Scanning technology, accounting software integrations, and custom approval workflows.

Utilise domestic and cross-border payment services provided by Spenmo’s partner licensed payment service providers.

Corporate Debit Card

Access to Visa Debit Cards

Gain access and control to physical and virtual Corporate Debit Cards issued and processed by Spenmo’s partner licensed payment service provider to make reimbursements and out-of-policy spending a hassle-free accounting experience!

-4.gif?width=991&height=731&name=reimbursements%20gif%20(1)-4.gif)

Reimbursements

Enhanced visibility, reduce petty cash spend by 30%1

Disburse claims in a few clicks via our licensed payments partner while ensuring in-policy spending with our multi-level approval process.

1 based on internal customer interview

Seamless Accounting Software Integration

Close books up to 70% faster

Syncs seamlessly with Xero, Netsuite, Quickbooks, Jurnal, and more, ensuring faster reconciliation and accurate data.

ISO 27001 Certified

Spenmo's ISO 27001 certification signifies rigorous adherence to global information security standards, assuring clients that their data is meticulously safeguarded against potential threats.