Spenmo is a technical service provider that facilitates spend management and is not required to be licensed under the Payment Services Act 2019 of Singapore (“PS Act”). All payment services are provided by Spenmo’s partners (and not by Spenmo) , who are licensed major payment institutions under the PS Act.

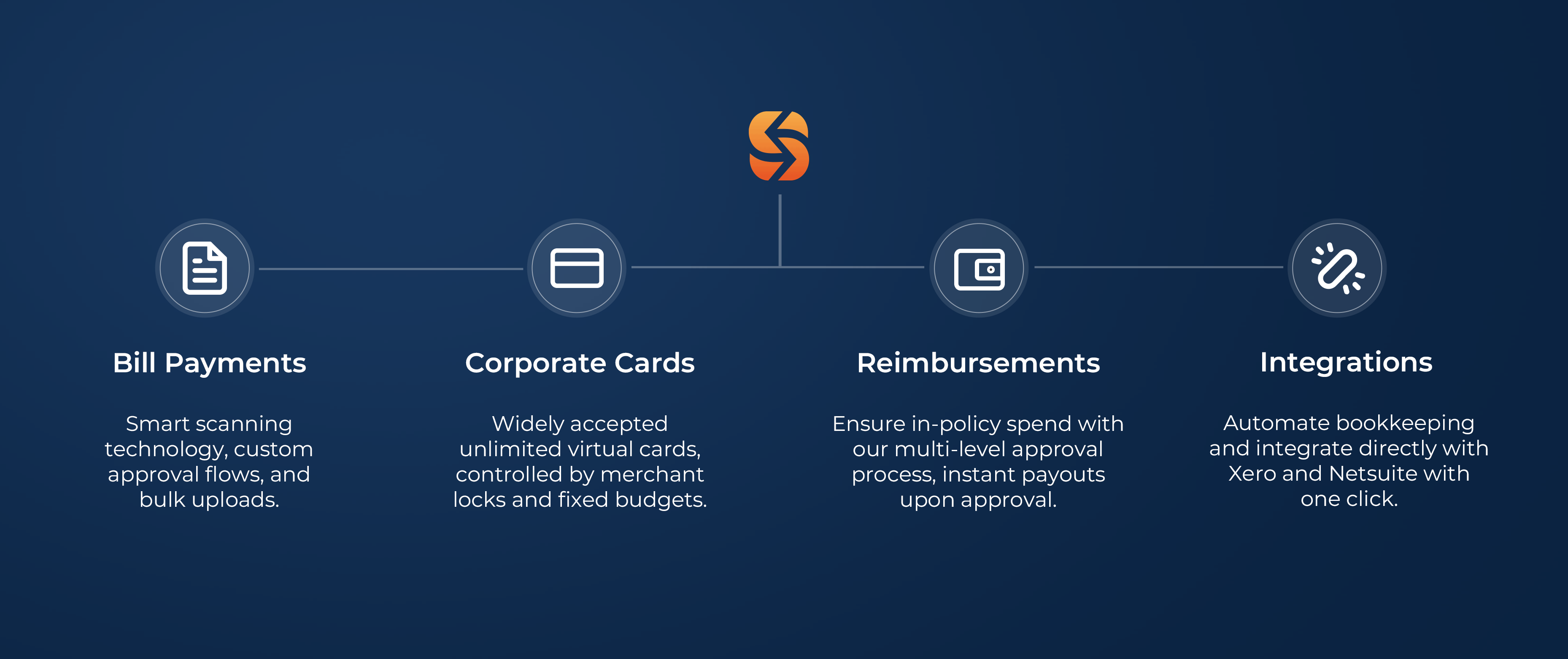

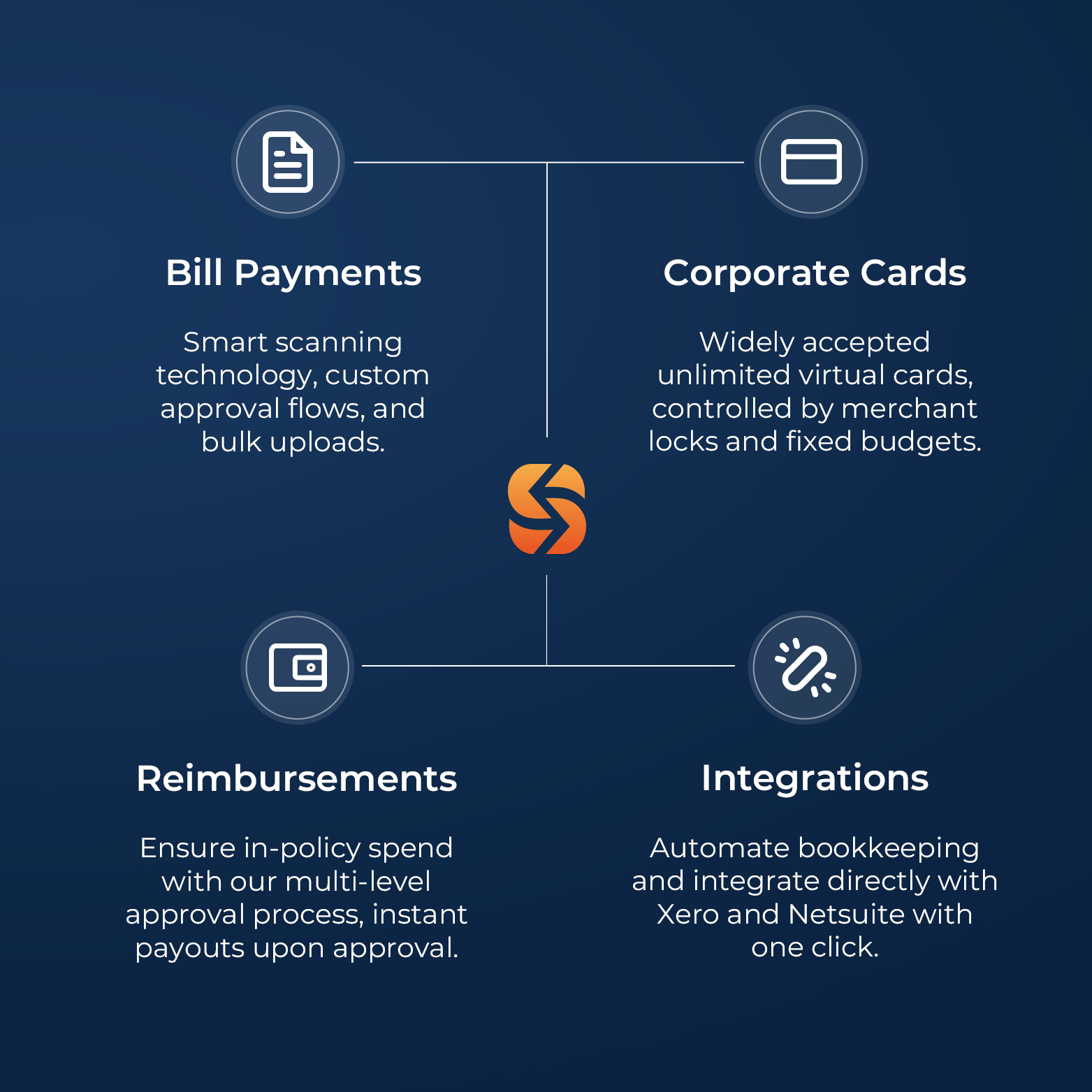

Streamline Company Spend While Maintaining Control

Spenmo empowers you with enhanced visibility and control to automate your existing spend management processes.

Streamline Company Spend While Maintaining Control

Spenmo empowers you with enhanced visibility and control to automate your existing spend management processes.

Your Co-Pilot in Steering Spend Control

Efficiency and Cost-Saving

Smart automation with guardrails, drive productivity and uncover cost savings

Gain Flexibility and Control

Seamless claims processing with spend and budget controls

Eliminate Out-of-Policy Spend

Enhance visibility with real-time dashboard and customisable approval flow

Reduce Reconciliation Headaches

Seamless accounting integration reduces manual entry and errors

Bill Management

Process your bills up to 90% faster

Reduce manual effort and errors while maintaining full control with our Smart Scanning technology, accounting software integrations, and custom approval workflows.

Utilise domestic and cross-border payment services provided by Spenmo’s partner licensed payment service providers.

Bill Management

Process your bills up to 90% faster

Reduce manual effort and errors while maintaining full control with our Smart Scanning technology, accounting software integrations, and custom approval workflows.

Utilise domestic and cross-border payment services provided by Spenmo’s partner licensed payment service providers.

Corporate Debit Card

Access to Visa Debit Cards

Gain access and control to physical and virtual Corporate Debit Cards issued and processed by Spenmo’s partner licensed payment service provider to make reimbursements and out-of-policy spending a hassle-free accounting experience!

-4.gif?width=991&height=731&name=reimbursements%20gif%20(1)-4.gif)

Reimbursements

Enhanced visibility, reduce petty cash spend by 30%1

Disburse claims in a few clicks via our licensed payments partner while ensuring in-policy spending with our multi-level approval process.

1 based on internal customer interview

-4.gif?width=991&height=731&name=reimbursements%20gif%20(1)-4.gif)

Reimbursements

Enhanced visibility, reduce petty cash spend by 30%1

Disburse claims in a few clicks via our licensed payments partner while ensuring in-policy spending with our multi-level approval process.

1 based on internal customer interview

Corporate Debit Card

Access to Visa Debit Cards

Gain access and control to physical and virtual Corporate Debit Cards issued and processed by Spenmo’s partner licensed payment service provider to make reimbursements and out-of-policy spending a hassle-free accounting experience!

Accounting Software Integration

Close books up to 70% faster

Syncs seamlessly with Xero, Netsuite, Quickbooks, Jurnal, and more, ensuring faster reconciliation and accurate data.

Seamless Accounting Software Integration

Close books up to 70% faster

Syncs seamlessly with Xero, Netsuite, Quickbooks, Jurnal, and more, ensuring faster reconciliation and accurate data.

ISO 27001 Certified

Spenmo's ISO 27001 certification signifies rigorous adherence to global information security standards, assuring clients that their data is meticulously safeguarded against potential threats.